Take a look at Google's prototype self-driving car in action:

To learn more, call (804)651-5400 or (919)348-9153 or visit us online at www.robinsonanalytics.com

Thursday, May 29, 2014

Google finally discloses its diversity record, and it’s not good

BY MURREY JACOBSON May 28, 2014 at 6:00 PM EDT

In an industry that has been famously guarded about its workplace diversity, Google on Wednesday disclosed its record when it comes to hiring women, African-Americans and Hispanics. The data reveals statistics that the company itself admits are too low and strikingly below other industry averages.

Women comprise just 17 percent of its global tech workforce, according to data Google published on its website and released exclusively to the PBS NewsHour. When it comes to leadership, women only account for 21 percent of the top positions in the company, which has a workforce of just under 50,000 people.

To continue reading click Google Disclosed Workforce Diversity Data

Wednesday, May 28, 2014

4 Reasons Your Payroll Costs Will Soon Explode

BY GENE MARKS @GENEMARKS

Whether you like it or not, the facts are that your payroll costs will be exploding over the next few years.

What are the three biggest line item expenses on your income statement? If you're like most companies, the three are taxes, materials and payroll. If you're in the service business it's just taxes and payroll. Since the recession, payroll costs have not risen very much. And during this period, with unemployment high, the threat of losing key employees was not substantial. And the opportunities for finding talented people at a bargain were a-plenty. But no longer.

In the next few years you will see an explosion in your payroll costs. They will rise, overall, between 5 and 10 percent depending on your industry and your region. Whether it is the wages you pay or the cost of benefits such as healthcare, you'll be spending more to employ. Why?

1. There will be an increase in the national minimum wage.

It's a foregone conclusion that minimum wages will be going up. People like to point to Washington State and San Francisco--two places with some of the highest minimum wages in the country that have also experienced significant economic growth--as one of the most persuasive arguments why an increase is justified. But that's not really the reason. (Your state would grow more than the sickly national average, too, if you had companies like Amazon, Microsoft and 10 zillion venture capital firms from Silicon Valley located there.

The real reason is because companies like Walmart are now caving. They're adjusting to the political landscape. And let's face it: $7.25 an hour is pretty darned low no matter how you slice it. I wouldn't expect the federal minimum wage to go as high at $15 per hour like the mayor of Seattle is proposing. But if you're still paying the minimum, you can expect to see this go up to somewhere around $10 per hour sometime in the next year or so. That's a 43% increase by the way.

2. Your healthcare costs will go up.

Most business owners I know, regardless of the number of people they employ, are steeling themselves for an increase in premiums over the next few years. The reason is math. There are between 30 to 34 million uninsured in the U.S. These people were, as of Jan. 1, required by law to get insurance. The insurance companies are now required by law to provide a host of essential benefits in return for this huge new market of customers. Except as of now, most of these 30 to 34 million haven't shown up. In fact, only 26 percent of the people that signed up on healthcare.gov did not have health insurance, according to survey this week. What happens if the rest of the uninsured--the young, the evasive, the gamblers--don't show up? Who will pay for those increased health costs that our insurance companies are now required to provide? Yeah, you guessed it. And so have many business planners.

To continue reading click 4 Reasons Your Payroll Costs Will Soon Explode

Manage your sales team for maximum performance

We are in a

growing economy. So our company is in an

environment that is improving. Are we maximizing

our sales potential in this environment?

Is our sales area being managed for maximum sales growth? In order for us to maximize our sales

potential, we need to provide our sales team with the tools and resources they

need, compensation, training and a manager who can strategically lead them in a

way that captures the sales potential.

We are in a

growing economy. So our company is in an

environment that is improving. Are we maximizing

our sales potential in this environment?

Is our sales area being managed for maximum sales growth? In order for us to maximize our sales

potential, we need to provide our sales team with the tools and resources they

need, compensation, training and a manager who can strategically lead them in a

way that captures the sales potential.

One of the most important contributors to outstanding sales

success is having the right sales manager in place. This sometimes doesn’t happen because we use

promotion as a way to reward our star sales people. We don’t have the appropriate incentives in

place for our star sales people and so reward them with a promotion. When we know they are not the best person to

lead the sales team. This also happens

because we hire the wrong person outside the firm to lead our sales area.

When we look at selecting a sales

manager for our team, we need to focus growing people for this position who

have the right strengths (the right bundle of talent, knowledge and skills). In other words, when we select these individuals

to be sales professionals on our team, we are already looking at their

strengths to see if they have what it takes to go to the next level. Then we focus on growing them into the sales

manager that we need.

This is also true if we are looking outside the firm for a sales manager. Sure we look for the appropriate education and experience. But we look deeper than that. We look at their talent, recurring patterns of thinking, feeling and behavior. This tells us if they have the innate ability to function well in the sales manager role.

When individuals are hired into a sales manager role, one of

their universal complaints’ is that they don’t receive much training, if any. (In our “The One Thing You Need to Know about

Great Managing” program, we teach the essential components of great managing. These skills are necessary to propel your

management into improved business performance.)

Once the individual has been promoted or hired, then they

need to know how to strategically lead their team in a way that will maximize

their effort. This is not just managing

to the sales funnel or the goals that have been set. It’s deeper than that. It’s a strategic way of managing that will

engage the team and maximize their performance.

To discuss or request a talk be given about this topic, call

Amos B Robinson, Practice Leader (Article Author)

“We help work places

become more profitable, productive and happy”

(804)651-5400

www.robinsonbc.com

Tuesday, May 20, 2014

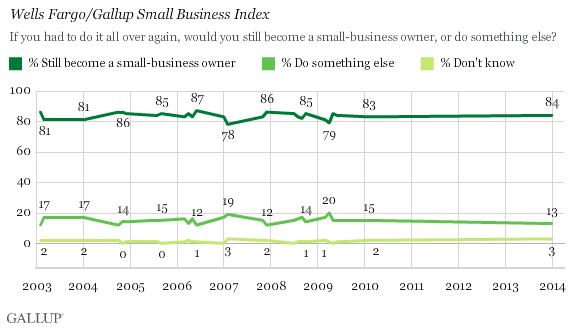

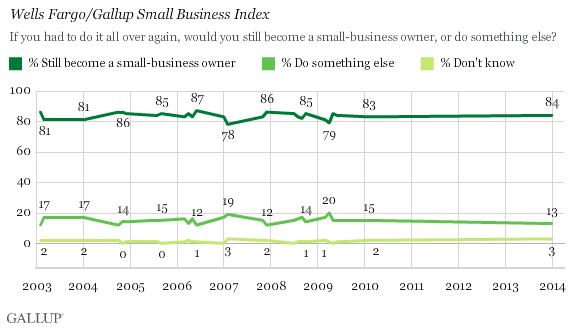

Small Business Owners are Content with Their Decision to Start Their Own Firm

Small business owners are content with their decision to start their own firm. 84% of small businesses say this. It is surprising that the Great Recession hasn't really affected this thinking. This level of satisfaction with having started their business has remained fairly stable through the recession and the recovery. The main reason for their satisfaction, they say, is due to the independence that the business affords them.

However, the small business owners say that his/her main challenge is maintaining and growing revenue. So the maintenance of their customers and growing their customer base is of primary importance. Their secondary challenge is making sure that they maintain adequate cash flow.

To schedule a discussion session, call

Amos B Robinson, Practice Leader

Robinson Business Consulting, LLC

"We help workplaces become more profitable, productive and happy"

(804)651-5400

www.robinsonbc.com

However, the small business owners say that his/her main challenge is maintaining and growing revenue. So the maintenance of their customers and growing their customer base is of primary importance. Their secondary challenge is making sure that they maintain adequate cash flow.

To schedule a discussion session, call

Amos B Robinson, Practice Leader

Robinson Business Consulting, LLC

"We help workplaces become more profitable, productive and happy"

(804)651-5400

www.robinsonbc.com

Friday, May 16, 2014

China to Overtake U.S. as Worlds Largest Economy in 2014

The World Bank ICP has put together a graphic to show the statistics of each country's PPP GDP. This grapahic reflects 2011 data. When you extrapolate the growth rates for the United States and China out to 2014, you see that based on PPP (not Exchange Rates) China's GDP will overtake that of the United States some time during 2014. Hover your mouse over the various countries below to read the various economic statistics. This graphic is being fed by the World Bank ICP website.

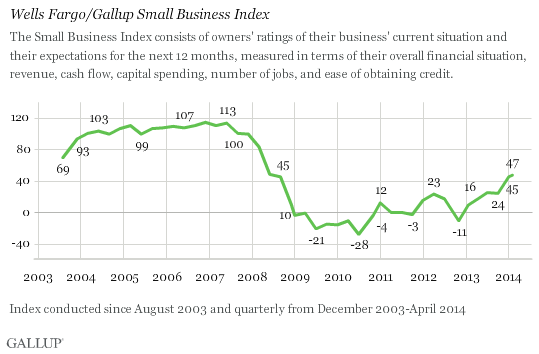

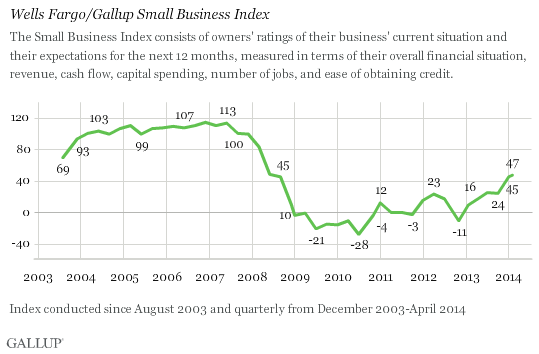

Small Business Climate is Improving

The Wells Fargo Small Business Index was just released and we have some more good news here. The index has been steadily recovering since the Great Recession. The Small Business Index is now at the highest point that it's been since the Great Recession. However, it has still not recovered to pre-recession levels. It looks like small businesses are more satisfied now with their ability to have ready access to credit and that is what is driving this latest improvement.

To schedule a discussion session, call

Amos B Robinson, Practice Leader

Robinson Business Consulting, LLC

"We help workplaces become more profitable, productive and happy"

(804)651-5400

www.robinsonbc.com

To schedule a discussion session, call

Amos B Robinson, Practice Leader

Robinson Business Consulting, LLC

"We help workplaces become more profitable, productive and happy"

(804)651-5400

www.robinsonbc.com

Thursday, May 15, 2014

Good News on the Private Sector Employment Growth Front

Earlier this month we got some good news from ADP. They produce a monthly private sector employment report based upon their payroll data. They reported that the U.S. economy created over 200,00 jobs for the month of April. When I graphed this out for the year so far, there is definitely and upward trend in our private sector employment growth situation. This is good new for the employers, because they are growing their businesses and this is good news for workers and those who want to work.

To have a discussion session, call

Amos B Robinson, Practice Leader

Robinson Business Consulting, LLC

(804)651-5400

www.robinsonbc.com

To have a discussion session, call

Amos B Robinson, Practice Leader

Robinson Business Consulting, LLC

(804)651-5400

www.robinsonbc.com

Monday, May 12, 2014

U.S. Construction industry Still Recovering

We are still recovering in the U.S. construction industry. As you can see from the graph, we have over 200 billion to grow to fully recover to our pre-recession level of construction spending. Our public sector spending has recovered but our private sector spending (The largest area of our construction spending) still has a ways to go. This tells you how bad the 2008 financial crisis really was. Because we are still recovering and we are 8 years from our peak spending year in 2006.

To schedule a discussion session, simply call

Amos B Robinson, Practice Leader

Robinson Business Consulting, LLC

(804)651-5400

www.robinsonbc.com

To schedule a discussion session, simply call

Amos B Robinson, Practice Leader

Robinson Business Consulting, LLC

(804)651-5400

www.robinsonbc.com

Friday, May 9, 2014

Retail Sector Of Our Economy Continuing to Restructure

This past Christmas season, 2013, marked a change in the retail sector of our economy. For the first time, the growth in online retail sales accounted for the increase in retail sales for the Christmas season versus sales growth attributed to our retail brick and mortar stores. Online sales are becoming a more important factor in growing your retail sales today.

This restructuring in the retail sector is evident with the continuing loss of jobs in the retail sector. The number one area of job cuts in the U.S. economy for the first 4 months of 2014 is retail.

Top 5 Job Cutting Industries in April:

Retail 6,993

Financial 4,124

Aerospace/Defense 4,075

Health Care/Products 3,242

Food 2,865

To explore a report on this subject, click Sad Slow Death Of Americas Retail Workers

To schedule a discussion session call

Amos B Robinson, Practice Leader

Robinson Business Consulting, LLC

at (804)651-5400

www.robinsonbc.com

This restructuring in the retail sector is evident with the continuing loss of jobs in the retail sector. The number one area of job cuts in the U.S. economy for the first 4 months of 2014 is retail.

Top 5 Job Cutting Industries in April:

Retail 6,993

Financial 4,124

Aerospace/Defense 4,075

Health Care/Products 3,242

Food 2,865

To explore a report on this subject, click Sad Slow Death Of Americas Retail Workers

To schedule a discussion session call

Amos B Robinson, Practice Leader

Robinson Business Consulting, LLC

at (804)651-5400

www.robinsonbc.com

How can small to medium sized business owners and sales professional’s best grow their sales?

The economy is currently growing and in a growing economy, no matter how slow, we need to be focusing on growing the sales of our firm or business. So how can we as business and sales professional’s best grow our sales? It’s done by increasing our customer engagement. In a matter of fact, customer engagement is the best way to grow our firms through organic sales. Another name for growing our firms in this way is called growing your customer base in the emotional economy.

Research shows that rationally satisfied customers will leave you or force you into a relationship that can be win/loose. In other words, if your customer does not have an emotional connection with you, your firm and its’ products and services, then you are at greater risk that they will turn over or insist on lower prices that lead to lower margins that lead to lower business performance.

Soft stuff like emotions really count with customers. As Simon Cooper, former president and CEO of The Ritz-Carlton Hotel company expressed: “When it comes to the customer, feeling are facts.” We have to understand that we not only have to meet the rational needs of our customer but we also have to meet their emotional requirements as well.

In addition to the rational needs of our customers there are four emotional needs that are based upon a hierarchy that must be met as well. These four customer engagement hierarchy of emotional needs are Confidence, Integrity, Pride and Passion. When customers feel that that these emotional needs are meet every time they do business with you, they are much likelier to become emotionally engaged with your company, which has a positive effect on with your sales results.

To discuss or request a talk be given about this topic,

call Amos B Robinson, Practice Leader (Article Author)

“We help work places become more profitable, productive and happy”

(804)651-5400

www.robinsonbc.com

Thursday, May 8, 2014

Entrepreneurship Is On The Decline In The United States

As the below graph indicates (courtesy of the The Brookings Institution), we have had a steady decline in business formation over the past 30 plus years. My concern is that entrepreneurship is the driver of job growth. If there is not a focus put on entrepreneurship and policy decisions made to create an environment for businesses to form, more challenge on the job creation front is in store.

To access the complete report click Decline of Business Formation in the United States

To access the complete report click Decline of Business Formation in the United States

It is possible to reduce this cost category by as much as 70 to 75%

Healthcare costs are one of the significant costs that businesses and individuals have to deal with today. The United States spent $2,500.000,000,000 on healthcare in 2009 (two and a half trillion dollars). Almost half of this comes from Medicare and Medicaid, and the other half comes from private insurance and out-of-pocket spending. This means that the average American pays $8,000 per year per person for healthcare. To give you some perspective on this, our annual spending on the Afghanistan and Iraq war was costing us $200 billion per year. To give you another comparison on how significant this is the country of India GDP is 1.5 trillion. That figure represents their whole economy.

One of the surprising facts that many businesses and individuals don’t know is that according to the Centers for Disease Control 70 to 75% of healthcare costs are related to preventable diseases, such as diabetes, heart disease and obesity.

So what can we do as businesses and individuals to help control our healthcare cost and help our national cause? It basically boils down to the basics of sleep (rest), water intake, diet and exercise. According to a survey of 400,000 Americans, only 27% get the recommended 30 minutes or more of exercise five days a week. People who exercise at least two days a week are happier and have significantly less stress. Research shows that the benefits from exercise increases the more we exercise but starts to diminish in benefit beyond 6 days in a week.

Researchers monitored participants in a bicycle riding exercise and observed that individuals that exercised in this way for at least 20 minutes experienced a better mood for 2, 4, 8, and up to 12 hours when compared with those who did not exercise.

As a Mayo Clinic publication stated: “A lack of energy often results from inactivity, not age”. As we increase our exercise, we will not only impact our mood but our health, costs and productivity.

To discuss or request a talk be given about this topic, call

Amos B Robinson, Practice Leader (Article Author)

“We help work places become more profitable, productive and happy”

(804)651-5400

www.robinsonbc.com

Wednesday, May 7, 2014

How do we improve performance in a slow growth environment?

There is no doubt about it we are still in challenging times. Even though the economy has been growing and is continuing to grow, that growth is sluggish. For example, second quarter GDP growth was 1.7%, much slower than the 3%+ growth rate that we have historically experienced here in the U.S. With the political campaigns fully engaged it is creating a mood that is not putting our consumers in a growth orientated type of mood. So what as business leaders can we do?

Since we can’t control the political aspect of the economy (the perceptions of consumers reactions to the political environment), we need to control the aspect of our organization that will support the growth of our businesses and enterprises, the level of engagement of our customers and our employees.

I was reading recently what one Chief Financial Officer gave as his strategy to deal with a slow economy. His answer was to place tight control on costs and to keep a lid on the hiring of new personnel. He also said in the story that his main motivator to keep his employees happy is to give them overtime. With wages not growing as they used to, there is no doubt that his employees will appreciate the additional income. But this CFO is directing his company in a way that leaves money on the table.

What this CFO needs to do in addition to controlling his costs and managing his head count, is make sure that his customers and team members are fully engaged. Because engaged customers buy more often, spend more money on their purchases and afford us a higher margin on the products we sell. It’s all about growing our businesses organically in the emotional economy.

One 30 branch retail bank put this strategy in place and actually increased their earnings by 2% while the average of their peer’s earnings declined by 8% in this sluggish and slow growth economy.

To discuss or request a talk be given about this topic, call

Amos B Robinson, Practice Leader (Article Author)

“We help work places become more profitable, productive and happy”

(804)651-5400

www.robinsonbc.com

Since we can’t control the political aspect of the economy (the perceptions of consumers reactions to the political environment), we need to control the aspect of our organization that will support the growth of our businesses and enterprises, the level of engagement of our customers and our employees.

I was reading recently what one Chief Financial Officer gave as his strategy to deal with a slow economy. His answer was to place tight control on costs and to keep a lid on the hiring of new personnel. He also said in the story that his main motivator to keep his employees happy is to give them overtime. With wages not growing as they used to, there is no doubt that his employees will appreciate the additional income. But this CFO is directing his company in a way that leaves money on the table.

What this CFO needs to do in addition to controlling his costs and managing his head count, is make sure that his customers and team members are fully engaged. Because engaged customers buy more often, spend more money on their purchases and afford us a higher margin on the products we sell. It’s all about growing our businesses organically in the emotional economy.

One 30 branch retail bank put this strategy in place and actually increased their earnings by 2% while the average of their peer’s earnings declined by 8% in this sluggish and slow growth economy.

To discuss or request a talk be given about this topic, call

Amos B Robinson, Practice Leader (Article Author)

“We help work places become more profitable, productive and happy”

(804)651-5400

www.robinsonbc.com

Subscribe to:

Comments (Atom)